On May 3, 2023, New York State Governor Kathy Hochul announced that, as part of the approved fiscal year 2024 New York State Budget, New York State will raise minimum wage with annual increases in 2025 and 2026. This alert provides essential details on the upcoming changes, which go into effect on January 1, 2024, including how they may impact businesses and important actions to consider now in order to prepare.

Minimum Wage Increase

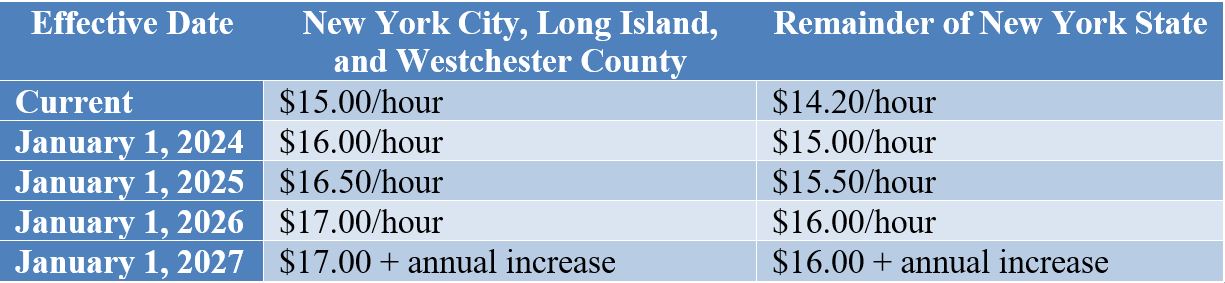

Minimum wage rates in New York State will be raised incrementally each year, on January 1, until the minimum wage reaches $17 per hour in New York City, Long Island, and Westchester County and $16 per hour for the remainder of the state in 2026. Below is a table of scheduled minimum wage increases.

Starting in 2027, the NYS Department of Labor will determine future annual minimum wage increases based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), keeping pace with inflation and regional living costs. This means future increases in 2028 and beyond will be tied to inflation and keep pace with the rising costs of living based on the region where an employee works.

Impact on Exempt Salary Threshold and Credits

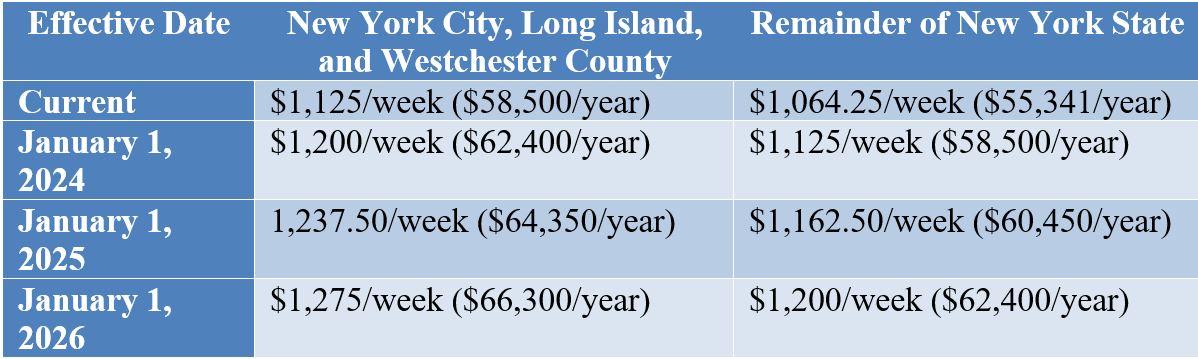

In addition to the increased minimum wage for nonexempt employees (those eligible for overtime), the minimum salary for exempt employees (those ineligible for overtime) is also expected to be raised over time.

The exempt salary threshold, currently set at $58,500 per year ($1,125 per week) in New York City, Long Island, and Westchester and $55,341 per year ($1,064.25 per week) in the rest of the state, will rise proportionately with the minimum wage. The table below illustrates the anticipated increases in the minimum annualized salary for exempt employees, which must be paid to employees at a consistent rate throughout the year. Said differently, employers cannot pay employees additional monies for work already performed to bring those employees above the threshold to avoid paying overtime.

Employers are not required to pay overtime to their exempt employees so long as they fall into an exemption category and are paid the minimum salary threshold. Key factors to determine an employee’s exempt status include pay rate, job duties, and responsibilities. If those factors are not met, employees may be determined to be misclassified and therefore eligible for unpaid overtime (and the employer may be subject to other fines and penalties in addition to unpaid overtime).

Preparing for the Minimum Wage Changes

The impending increase in New York State’s minimum wage presents the perfect time for employers to take proactive measures to prepare and protect their businesses. Not only does this upcoming mandatory change necessitate immediate action to ensure compliance, it also presents a unique opportunity to address issues that have gone unnoticed. Proper planning and implementing safeguards now can and will save businesses from the devastating consequences of noncompliance.

Highly Recommended Actions

As an employer, now is the time to prepare for these imminent changes.

- Identify nonexempt hourly workers, and be ready to update their payroll information and forecast the increased minimum wage (and overtime) on your payroll. Even if you don’t employ minimum wage workers, consider increasing hourly rates to remain competitive in the labor market.

- For exempt employees, assess whether their salaries may fall below the threshold as it increases over the next few years. You should weigh the costs of raising their salaries to retain exempt status versus reclassifying them as nonexempt and eligible for overtime pay.

- Beyond the budgetary considerations, start planning for the yearly updates to your employee onboarding by providing them with proper Wage Acknowledgement Forms that are compliant with the Wage Theft Prevention Act, and coordinate with your payroll company to ensure your paystubs remain compliant.

Catch Problems Before They Escalate

The increase in minimum wage also presents an excellent opportunity to catch any employment practice issues that may have slipped through the cracks. It’s time to ensure all missing onboarding documents are completed and signed. Implementing an auditing program can help identify and rectify any gaps in compliance, giving you peace of mind and minimizing legal risks going forward.

The Power of Proper Planning

Beyond merely informing you of the upcoming changes, we emphasize the importance of developing proactive strategies to comply with employment regulations. Effective planning and timely implementation will not only avoid penalties but will also cultivate a workplace environment that values compliance and protects both employees and employers. This includes making sure your employee handbooks, posters, notifications, and acknowledgments are compliant and your employee onboarding, offboarding, and pay practices are correct.

Mitigating Risks: The Staggering Costs of Audit and Litigation

The costs of facing a NYS Department of Labor audit or private litigation for failing to comply with minimum wage rules can be staggering. By staying ahead of the changes and meticulously adhering to employment regulations, you can prevent these costly consequences.

Barclay Damon is committed to helping employers embrace change like the upcoming minimum wage increases and implement employment practices that are specifically tailored to each employer’s business and industry.

If you have questions regarding the content of this alert, please contact a member of the firm’s Labor & Employment Practice Area or Hotels, Hospitality & Food Service Team.