Does your estate plan include a “Santa Clause?” The New York State estate tax exclusion amount in 2022 is $6,110,000. This is the amount an individual can leave to their (non-spousal) beneficiaries without paying New York State estate taxes. However, New York State has intentionally structured the estate tax system to eliminate any estate tax credit and impose a highly punitive and costly tax on any taxable estates in excess of 105 percent of the New York State exemption amount (the estate tax cliff). In 2022 taxable estates over $6,415,500 “fall off the cliff” and are allowed no estate tax credit. The Santa Clause discussed below will eliminate the effects of falling off the cliff, the imposition of the punitive tax, and will allow more of your wealth to pass to your chosen beneficiaries instead of the New York State Department of Taxation and Finance. It is important for everyone to know whether they risk falling off the New York State estate tax cliff and to take appropriate planning steps to mitigate or eliminate the draconian tax effect that can occur.

An estate will lose any New York State estate tax exemption and will be subject to estate tax from dollar one if the taxable estate is equal to 105 percent or more of the estate tax exclusion amount. An estate subject to the cliff pays estate tax on the full value of the estate with no applicable credit to apply against the tax.

Estates that are valued between the exclusion amount and 105 percent of that amount are subject to a phased-out credit. Estates between $6,110,000 and $6,415,500 receive the phased-out credit and pay a highly punitive estate tax that results in the amount above the exclusion amount being taxed at an effective rate far greater than 100 percent. Estates valued over the cliff and up to $6,711,000, are also subject to the highly punitive effective tax rate. The result of an estate valued in this range ($6,110,000–$6,711,000) is that the net amount left to your beneficiaries after taxes is less than it would have been if your taxable estate was worth $6,110,000.

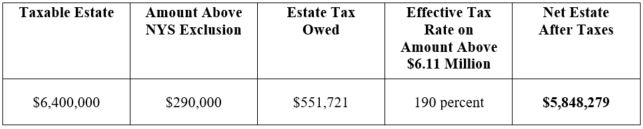

Suppose Maria has $6,400,000 in her taxable estate when she dies. The below chart illustrates how her estate will be taxed.

Maria’s children will be left with an estate of only $5,848,279 after taxes, which is $261,721 less than if her estate was worth $6,110,000. Taken to the extreme, Maria could have saved $551,721 by giving away $290,000 before she died.i The money paid in taxes as a result of falling off of the cliff could have been used for any number of purposes, such as buying a home, paying off student loans, or even paying college expenses.

Is there a way other than burning cash to deal with the New York State cliff and leave more for your beneficiaries? Yes! Fortunately, the cliff can be avoided by using a “Santa Clause” to reduce your taxable estate to the estate tax exclusion amount. A Santa Clause is a conditional formula bequest that leaves money to your preferred charity (or one chosen by your executor or trustee), but only if doing so will result in a higher after-tax estate for your beneficiaries.

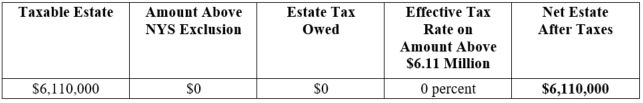

Suppose Maria chose to leave whatever amount was necessary to avoid the New York State estate tax cliff to a tax-exempt charitable organization supporting causes that Maria believes in. Because the bequest is conditional, it only takes effect if it results in less overall tax paid and more money for Maria’s loved ones. In this case, the Santa Clause would result in a bequest of $290,000 to charity, an additional $261,721 for her children, and no taxes paid to New York State.

Compare the effect of including a Santa Clause in Maria’s estate plan:

Note that the Santa Clause works for taxable estates in a certain range: from the New York State estate tax exemption amount to approximately 109.8 percent of that exemption amount. For estates outside that range, the Santa Clause is either not needed or will not work to save estate tax. Since no one knows exactly what their taxable estates will be when they die, if there is any chance that it might be subject to the New York State estate tax cliff, it is prudent to include a Santa Clause in their planning documents.

If you have any questions regarding the content of this alert, please contact David Luzon, partner, at dluzon@barclaydamon.com; Meaghan Murphy, counsel, at memurphy@barclaydamon.com; or another member of the firm’s Trusts & Estates Practice Area.

iThis gift would have had to have been made more than three years prior to death, as New York State claws back gifts made less than three years before death back into the taxable estate.